Workshop Objectives

A value-added tax (VAT) is a consumption tax placed on a product whenever value is added at each stage of the supply chain, from production to the point of sale. The amount of VAT that the user pays is on the cost of the product, less any of the costs of materials used in the product that have already been taxed. The primary objective of VAT is to remove the cascading effect of taxes and levies, which is generally prevailing in other types and manner of levy. The VAT concept is simple, transparent, and consistent in its form, content, structure and approach. It further ensures revenue neutrality and the mechanism must be self regulated.

This workshop will enable controllers, accounting and tax professionals to understand the importance of managing Value Added Tax transactions and balances. VAT management is not rocket science, but headaches can be avoided with a proper registration and control process in place. It will cover examples of VAT management, as well as; define Value Added Tax definition, discover how it works, recognize how to plan your balance and identify the risks of improper VAT management and Potential red flags around VAT treatment.

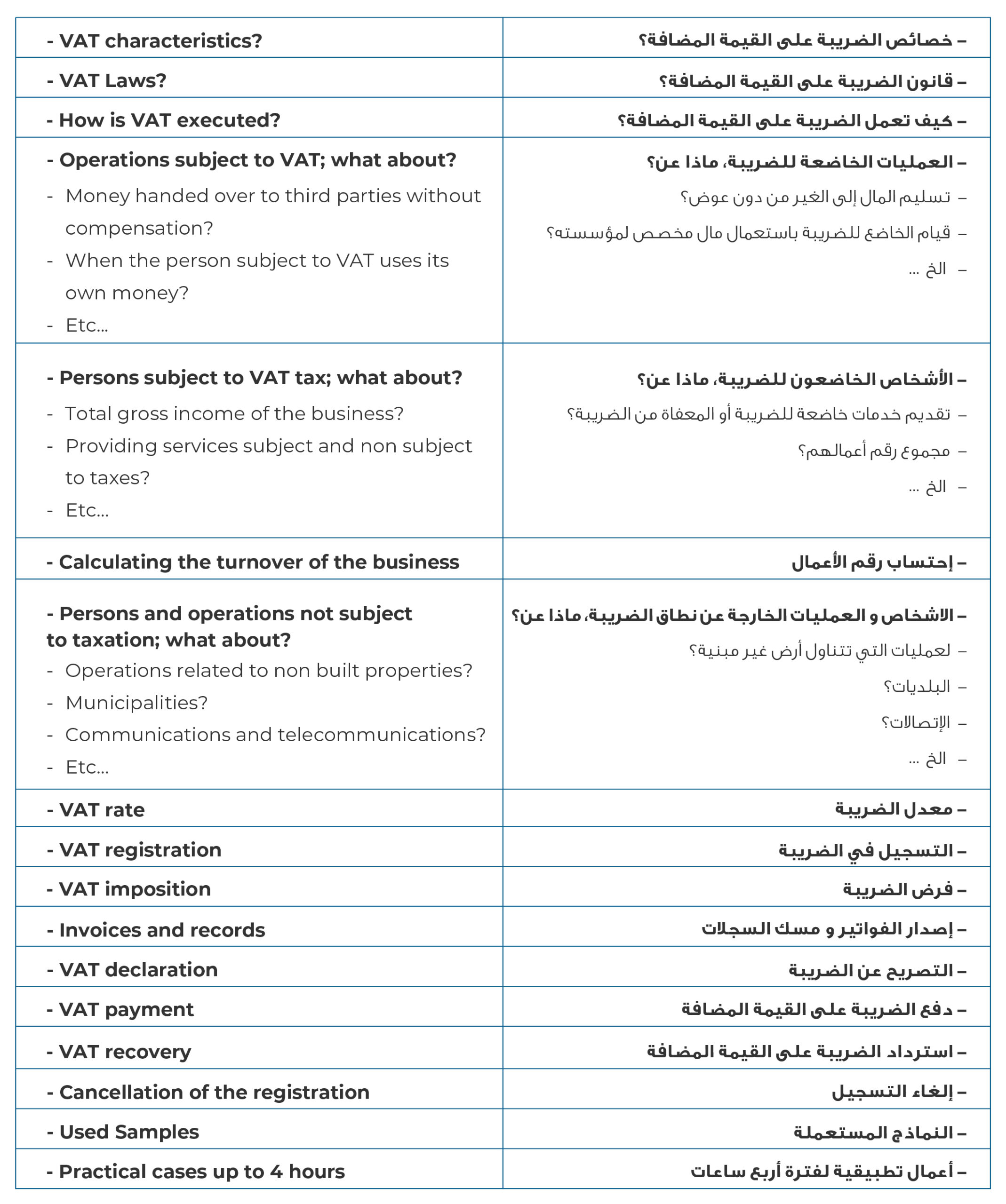

Workshop Outlines