Workshop Objectives

The primary purpose of taxation is to raise revenue to meet huge public expenditure. Most governmental activities must be financed by taxation. But it is not the only goal. In other words, taxation policy has some non-revenue objectives. In the modern world, taxation is used as an instrument of economic policy. It affects the total volume of production, consumption, investment, choice of industrial location and techniques, balance of payments, distribution of income, etc.

This workshop examines income tax aspects of the formations, distributions and liquidations of corporations. The focus is on transactional and planning aspects of the corporate tax.

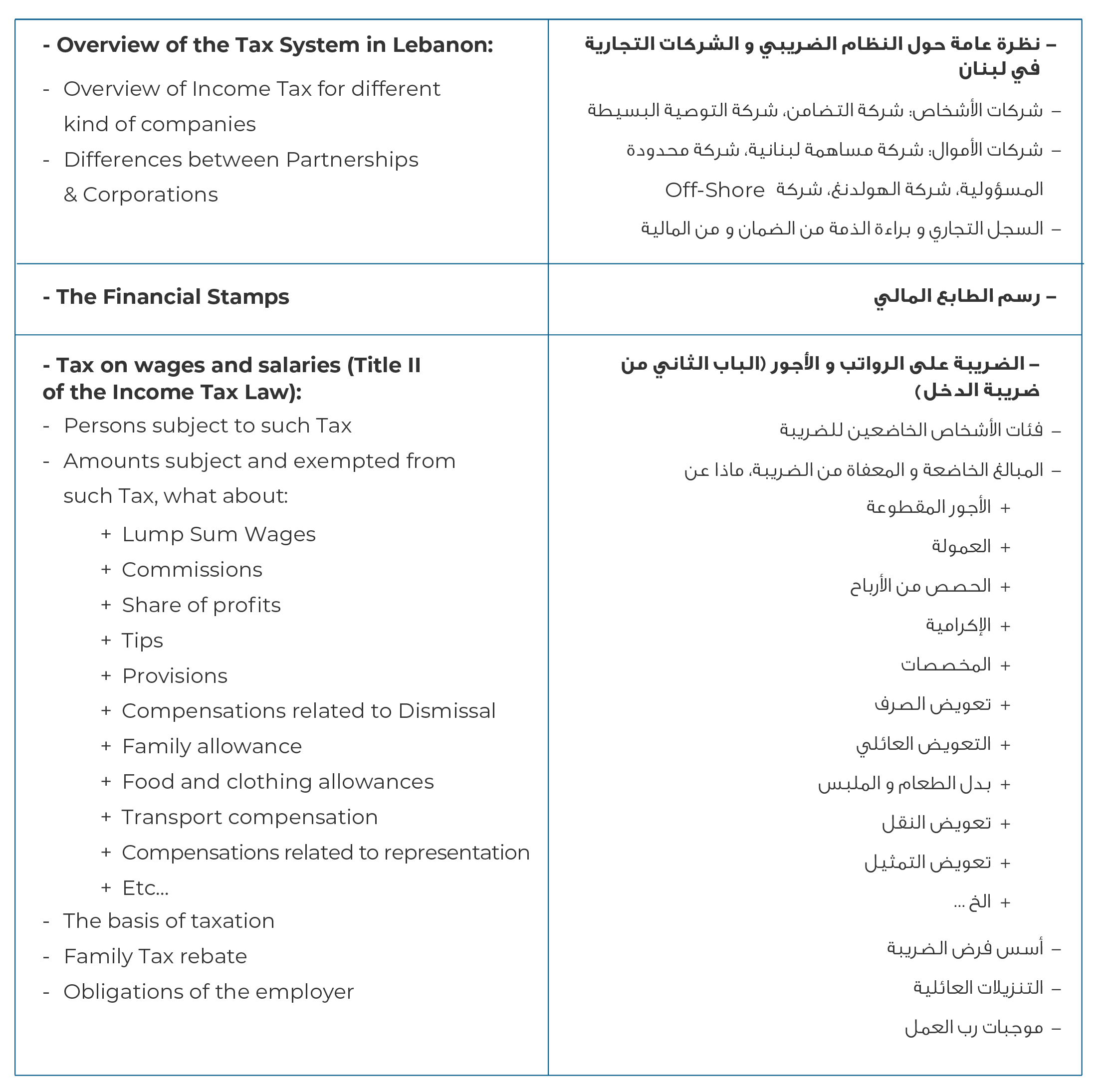

Workshop Outlines